Best Mutual Funds in 2013

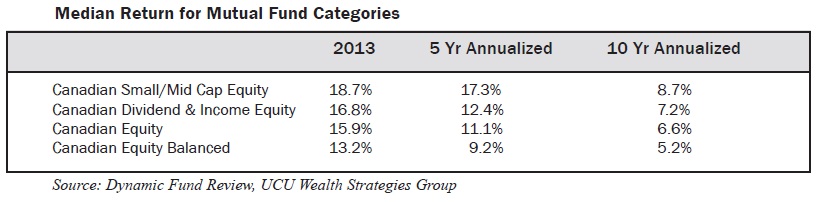

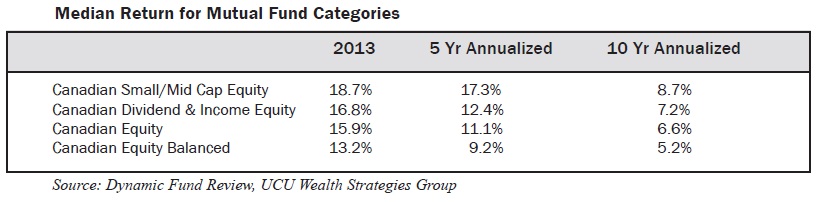

In an earlier article, we wrote about mutual categories and their performance in 2013. Among the categories we reviewed were four categories of funds which focus on Canadian securities. In the table below we highlight those categories of mutual funds, with their performance numbers for 2013, as well as annualized returns for the past 5 and 10 years.

In this article we focus on these categories because the majority of investors in Canada, as well as our readership, will be mostly invested in Canadian securities, and so it would naturally be interesting for this group to know more details about the performance of Canadian focused mutual funds.

The average return of all four categories of Canadian focused mutual funds outperformed the S&P/TSX Composite Index, which rose 9.6% in 2013. The best performing category on average was the Canadian Small/Mid Cap Equity funds, which focus on holding shares of small and mid-sized Canadian companies. These types of stocks are generally considered higher risk than the large, blue chip Canadian stocks such as Bell Canada or Rogers Communications, which would be more common in general Canadian Equity mutual funds. What’s also interesting is that even the categories of funds which focus on Canadian dividend payers or even balanced funds (which hold a mix of stocks and bonds) performed on average better than the S&P/TSX Composite Index.

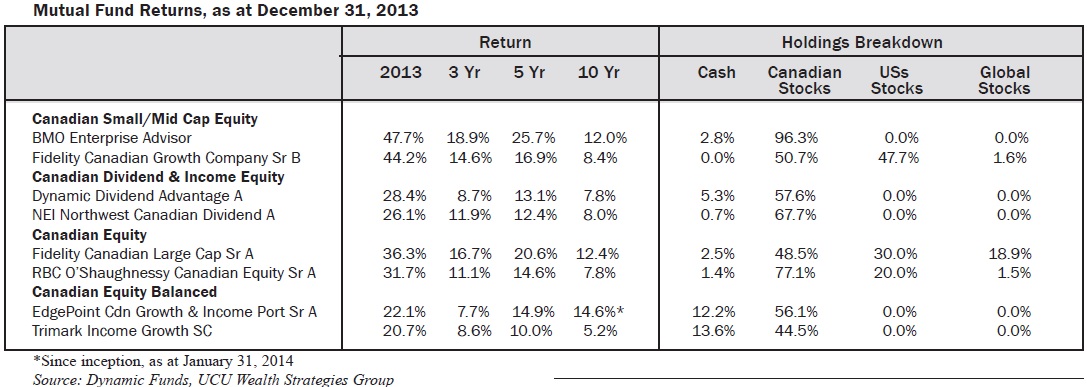

Below we highlight some of the top performing funds within each category, according to Dynamic’s Fund Review report for 2013.

What is clearly demonstrated by the table above is that the best performing mutual funds within each fund category doubled or almost doubled the average return of their respective category.

In particular, one of the best funds of those focused on Canadian securities, BMO Enterprise Advisor fund, achieved a 47.7% return while maintaining 96.3% of its assets invested in Canadian small and mid-sized stocks. This fund has had excellent return figures not only for the year 2013, but for longer time periods: the fund’s annualized return over the past five years amounted to 25.7%, and over the past ten years, to 12.0%.

Another strong performing fund in the Canadian Small/Mid Cap category, Fidelity Canadian Growth Company Series B, generated its strong returns in 2013 by holding a substantial amount of U.S. listed stocks; 48% of the assets held. Many Canadian mutual funds are allowed to hold up to 50% of their assets in foreign securities and still be considered “Canadian”. With Canadian markets lagging U.S. and European markets in 2013 it is not surprising to see Canadian mutual funds maximize their allowed foreign securities allocation. About 80% of this fund’s holdings were invested in sectors with higher than average returns in both the Canadian and US markets in 2013: Financials, Information Technology and Consumer Discretionary.

When reviewing mutual funds with the most impressive results, we would like to warn investors that past performance is not always a good indicator of future returns. We at Credential Securities Inc. at UCU’s Wealth Strategies Group will be happy to help you identify mutual funds that best fit your investment strategy.

Michael Zienchuk, MBA, CIM

Investment Advisor,

Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x204

mzienchuk@ukrainiancu.com

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit values and reinvestment of all distributions for the period ended December 31, 2013, and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.