Canadian

and Global Stock Markets in 2013

In

2013, the Canadian S&P/TSX Composite index lagged behind the

major stock indices of the world. During 2013, the S&P/TSX

Composite index’s return was less than 10%, at a time when the big

European indices returned 14%-25% and the U.S. indices returned over

26%.

In

2013, the Canadian S&P/TSX Composite index lagged behind the

major stock indices of the world. During 2013, the S&P/TSX

Composite index’s return was less than 10%, at a time when the big

European indices returned 14%-25% and the U.S. indices returned over

26%.

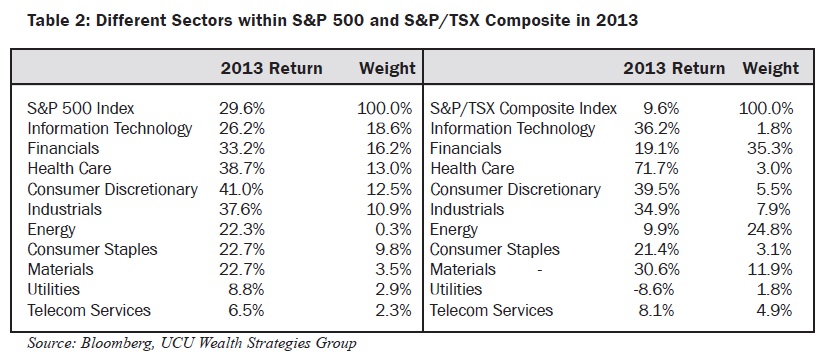

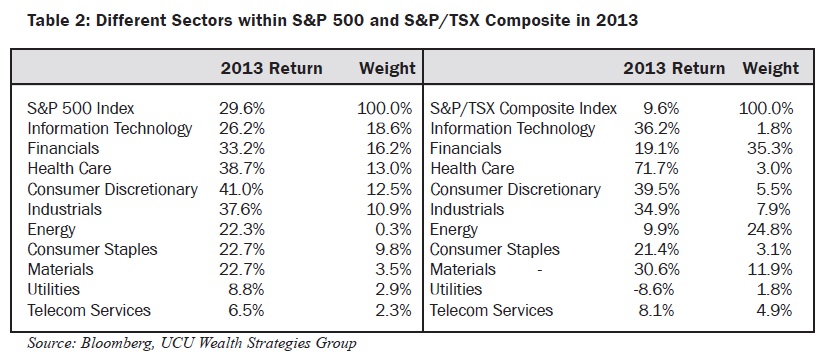

The

main reason for the weaker performance for the S&P/TSX Composite

index can be traced to its structure in terms of weightings of

industry sectors. If we compare the S&P/TSX Composite index (TSX)

to the S&P 500 index (SP500), better performing sectors have

considerably smaller weightings in the TSX than in the SP500, while

the poor performing sectors had much larger weightings in the TSX

than the SP500. For instance, Health Care, Consumer Discretionary and

Industrials sectors had 38%-41% annual returns in 2013 in the SP500,

each contributing between 11%-13% for the index overall return. At

the same time, Information Technology, Health Care and Consumer

Discretionary, which returned from 36%-72% in 2013 in the TSX, had

weightings from 1.8%-5.5%.

For

the below average performing sectors, these had substantially larger

impact on the TSX than on the SP500. In particular, Energy (up by

just 9.9% in 2013) and Materials (down 30.6% in 2013) had weights of

24.8% and 11.9% (combined weight of 36.7%) respectively in the TSX.

These same two sectors accounted for only 13.8% for the SP500.

The

biggest Canadian sectors by weight, Financials (35.3% in the S&P/TSX

Composite index), Energy (24.8%) and Materials (11.9%) did not

perform as well in 2013 as their counterparts did for the SP500.

Canadian Financials (banks, insurance companies, etc.) returned 19.1%

in 2013 as compared to 33.2% for U.S. Financials; Energy (oil and

gas, energy services, etc.) sectors in the two countries grew by 9.9%

and 22.3% respectively; and Materials (metals and mining, forestry,

etc.) in Canada dropped 30.6% while in the U.S. they rose by 22.7%.

Among

Canada’s top performers in the Health Care were stocks as Patheon

Inc (up almost 200% in 2013) and Valeant Pharmaceuticals

International, Inc (up around 100%). The top performer in the

Consumer Discretionary sector, Transat A.T. Inc (an integrated tour

operator), returned more than 110% in 2013. Air Canada’s stock rose

by more than 300% in 2013. However, Health Care, Consumer

Discretionary and Industrials (which includes airlines) sectors,

which grew handsomely in 2013, were not able to lift the S&P/TSX

Composite index higher due to their low weights in the index, 16.4%

altogether.

Among

the biggest losers in Canada’s worst performing sector, Materials,

were gold mining stocks, such as Barrick Gold, IAMGOLD Corp, Kinross

Gold Corp, and others fell in many instances by more than 40% in

2013. Much of this weak performance can be linked to the general

weakness in the price of gold in 2013, which fell by 28%.

Last

year, the U.S. stock exchanges grew strongly as corporate earnings

grew and indicators of economic development improved. European

exchanges benefited from recovery from the financial and economic

crisis of earlier years. The performance of the Canadian exchange was

particularly poor in the first half of 2013 when the TSX was down

more than 2%. The market improved in the second half of 2013, growing

by more than 12%. This helped the TSX post its best performance since

2010.

Michael

Zienchuk, MBA, CIM

Investment

Advisor,

Credential

Securities Inc.

Manager,

Wealth Strategies Group

Ukrainian

Credit Union

416-763-5575

x204

mzienchuk@ukrainiancu.com

www.ukrainiancu.com

Mutual

funds and other securities are offered through Credential Securities

Inc. Commissions, trailing commissions, management fees and expenses

all may be associated with mutual fund investments. Please read the

prospectus before investing. Unless otherwise stated, mutual funds

and other securities are not insured nor guaranteed, their values

change frequently, and past performance may not be repeated. The

information contained in this article was obtained from sources

believed to be reliable; however, we cannot guarantee that it is

accurate or complete. This article is provided as a general source of

information and should not be considered personal investment advice

or solicitation to buy or sell any mutual funds and other securities.

Credential Securities Inc. is a Member of the Canadian Investor

Protection Fund.

In

2013, the Canadian S&P/TSX Composite index lagged behind the

major stock indices of the world. During 2013, the S&P/TSX

Composite index’s return was less than 10%, at a time when the big

European indices returned 14%-25% and the U.S. indices returned over

26%.

In

2013, the Canadian S&P/TSX Composite index lagged behind the

major stock indices of the world. During 2013, the S&P/TSX

Composite index’s return was less than 10%, at a time when the big

European indices returned 14%-25% and the U.S. indices returned over

26%.