January

Effect and Other Stock

January

Effect and Other Stock

January

Effect and Other Stock

January

Effect and Other Stock

Market Seasonal Phenomena

Whether you already invest in stocks or are only considering this investment vehicle, you may be interested in a stock market theory called the “January Effect”. The January Effect states that each year, in December, many individual investors sell their stocks to claim a capital loss for tax reasons, which drives stock prices down. Then these same investors buy back those stocks in January, which helps drive prices back up. Another theory supporting stock price growth in January centres on the demand for buying stocks with year-end bonuses. Given that individual investors hold small-cap stocks more often than large institutional investors do, the January Effect is believed to be more influential on small-cap prices much more than larger-cap prices. Another part of the January Effect theory is that as goes January, so goes the year, and as the first five days of January go, so go January’s full-month returns.

The

January Effect theory has been widely scrutinized. According to

Charles Rotblut, vice president with the American Association of

Individual Investors (forbes.com), in 1950-2011, the S&P 500

index started January with five-day gains 38 times (or 62% of the

time). Full-year gains followed the positive starts in 33 out of

those 38 years (87% of the time). When the market started a new year

with a loss for the first five days of January, full-year performance

was mixed. Stocks rose 12 times and fell 11 times for an average

annual gain of 0.2%. Sam Stovall of S&P Capital IQ (forbes.com)

says that January declines led to negative full-year performance just

56% of the time since 1945. Therefore, it appears there is a stronger

correlation between positive returns in January and positive 12 month

returns, than there is a negative January return indicating a

negative year end returns.

The

January Effect theory has been widely scrutinized. According to

Charles Rotblut, vice president with the American Association of

Individual Investors (forbes.com), in 1950-2011, the S&P 500

index started January with five-day gains 38 times (or 62% of the

time). Full-year gains followed the positive starts in 33 out of

those 38 years (87% of the time). When the market started a new year

with a loss for the first five days of January, full-year performance

was mixed. Stocks rose 12 times and fell 11 times for an average

annual gain of 0.2%. Sam Stovall of S&P Capital IQ (forbes.com)

says that January declines led to negative full-year performance just

56% of the time since 1945. Therefore, it appears there is a stronger

correlation between positive returns in January and positive 12 month

returns, than there is a negative January return indicating a

negative year end returns.

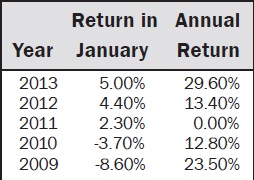

We looked at the S&P 500 index’s performance over the shorter term (see the table). In the past five years, there does not seem to have been a clear pattern for January to be indicative of the whole year’s performance. In two years, the stocks continued growing after growth in January, but, in three other years, stock movements in January and over the year were opposite.

There is also an opinion that stock price growth in January has been less evident lately because market participants are too expecting of it, while more and more investors are using tax-free retirement accounts where there is no benefit to tax-loss selling in December. Arthur Hill (the ChartWatchers blog) says that the price increases on the broad market happen in April and December rather than in January, and that in December small caps outperform large caps more often. He calculated that in April and December the broad market index S&P 500 grew 75% and 74% of the time in 1994-2013; while the small caps represented by the Russell 2000 index outperformed the large-cap index S&P 100 index in December 74% of the time over the same period. This analysis supports the stock market phenomena known as Santa Claus and Easter rallies.

When focusing on small-cap stocks, the January Effect theory seems to apply. According to marketwatch.com, professors Eugene Fama and Kenneth French calculated that the smallest 10% of stocks brought a 7.9% return on average in January between 1926 and 2011. This compares to an average 0.9% return in the other 11 months. The professors found no such anomaly in larger stocks.

One can see that there are no general rules that could be applied with high probability to all stocks in any given December-January period. Moreover, fundamental macro- and micro-conditions often have much stronger effects on stocks than seasonal trends do. A good example is December 2008 - February 2009 when the S&P 500 index, instead of growing, dropped by 22% as the global financial system was in turmoil. We at Credential Securities Inc. at UCU’s Wealth Strategies Group will be happy to help you figure out how investing in stocks fits your strategy, and find particular investment opportunities.

Michael Zienchuk

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

mzienchuk@ukrainiancu.com

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.