Dogs of the Dow

In the past we have written articles about strategies to help select stocks that would outperform the general market indices. In the current article, we would like to examine an investment strategy known as “The Dogs of the Dow” (“the Dogs”).

This strategy is credited to Michael B. O’Higgins who published the book “Beating the Dow” in 1991. The strategy is simple which attracts a lot of investor attention. It proposes each year on January 2nd to invest equally in the ten stocks of the Dow Jones Industrial Average (DJIA) index (30 stocks altogether) which have highest dividend yields. Dividend yield is the ratio of the annual dividend paid per share relative to the current price per share.

The Dogs strategy implies that the company will pay the same (or higher) dividend per share in the coming year despite the weaker performance of the shares in the previous year (hence, the higher dividend yields, since all stocks in the DJIA index tend to pay similar dividends). If the strategy works, the investor will benefit from the higher dividend yield as well as any growth in the share price. Investors who use this strategy find comfort in the fact that the companies which they select are blue chip stocks (hence they are in the DJIA index). The DJIA is constantly reviewed to include only strong, solid large-cap companies.

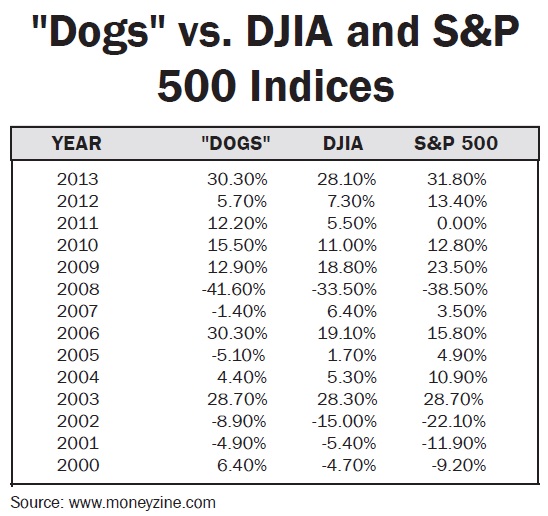

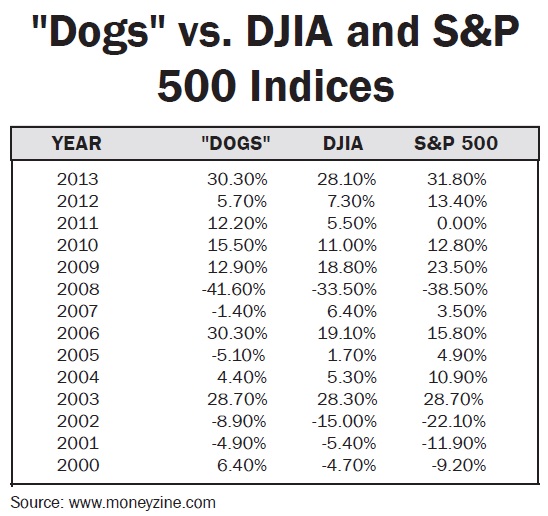

Over the past 20+ years, the “Dogs of the Dow” strategy has been put to test by numerous investment professionals and observers. O’Higgins back-tested the strategy to the 1920s and found that it consistently outperformed the wider market. In 1992-2011, the “Dogs of the Dow” matched the average annual total return of the DJIA (10.8%) and outperformed the S&P 500 (9.6%) (see Wikipedia and www.dogsofthedow.com). In 2000-2013, “the Dogs of the Dow” outperformed DJIA and S&P 500 in eight years out of 14 (see Table 1 on the top).

Over the 1992-2011 period, the “Small Dogs of the Dow”, which are the five lowest priced Dogs of the Dow (or “Dow 5”), outperformed both the DJIA and S&P 500 with an average annual total return of 12.6%. For each individual year within this period, performance of both the “Dogs of the Dow” and the “Dow 5” was different. For instance, both strategies did not outperform the DJIA during later stages of the dot-com boom (1998-1999) and during the financial crisis (2007-2009). This shows that this kind of strategy should be implemented with caution, as it isn’t fool proof in its outperformance.

Apart from the “Dow 5”, there are also other modifications of the “Dogs of the Dow”, which select stocks based on their prices. In particular, the “Dow 4”, which includes the four highest priced stocks of the “Dow 5”; and the “Foolish 4” which chooses the same stocks as the “Dow 4”, but allocates 40% of the portfolio to the lowest priced of these four stocks and 20% to the other three stocks (see Investopedia.com). Although in some past periods these strategies outperformed the DJIA and even the “Dogs of the Dow”, they should be considered with heightened care because share price, unlike dividend yield, is not necessarily indicative of value or of future performance.

There has been some recent criticism of the “Dogs of the Dow” strategy. Jack Hough of Barron’s (see Barrons.com) claims that the strategy does not work any longer. He believes that there is no reason to adopt the approach for 2014 because companies have changed the way they return cash to shareholders. According to Jack Hough, in 2013, big U.S. companies spent about $1.50 on share repurchases for each $1 they spent on dividends. He suggests that a “Dogs” strategy based on both dividends and share repurchases may beat the original “Dogs of the Dow” strategy and the wider market.

On numerous investment-related web-sites, you may find different dividend-based investment strategies and even a selection of stocks that fit those strategies. We strongly suggest that you consult with your investment advisor before you embark on any of those strategies. We at Credential Securities Inc. at UCU’s Wealth Strategies Group would be glad to help you choose a strategy that fits your investment priorities.

Michael Zienchuk

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group